31+ Calculating Late Fees

Web Penalty Calculator Penalties Overview 2019 2020 Penalty Relief Interest Rates Current year taxes are due on Tax Day April 15 as well as most state tax returns. May 15 2023 Invoice late fees help incentivize clients to pay on time and help freelancers avoid having to chase down payments.

Structural Diversity Of Nucleosomes Characterized By Native Mass Spectrometry Analytical Chemistry

A well-structured late fee policy.

. A charge a consumer pays for making a required minimum payment on a credit card after the due date. Invoices way past their due date. Web You open the Invoices screen and bring up the invoice 1005.

Web To calculate your interest charge on a late monthly payment divide your annual percentage rate -- APR for short -- by 12 and multiply it by your outstanding balance. Companies use late fees to compensate for. You can still manually apply late fees as a line.

Web Panna Kemenes 031221 updated more than 1 year ago 5 minute read Late fees can encourage on-time payment and lessen the impact of late payments on your cash flow. Enter the number of months late. Web QuickBooks only calculates and applies late fees to overdue invoices the day after you turn on the late fee setting.

Web The Credit Card Accountability Responsibility and Disclosure Act of 2009 CARD Act lays out that as of 2022 a credit card late payment fee cannot be higher. If a payment is more than a month late use the Monthly Compounding. For every month of unpaid taxes the late taxpayer will pay 5 of.

Late fees encourage consumers to pay on. Lost interest assuming youd. Web Agencies will use the following procedures in calculating interest due on late payments.

Enter the principal amount. Web The late payment penalty is 05 12 of 1 percent of the additional tax owed amount for every month or fraction thereof the owed tax remains unpaid up to a. Youve provided the agreed-upon service or product.

Web December 17 2020 Heres a situation no business owner or freelancer wants to deal with. You calculate the late fee for this invoice by setting the Create Late Fee Up To date to August 19. Web Up to 25 cash back Calculated properly late fees compensate the creditor you for the direct losses you suffer when the debtor doesnt pay on time.

Web Using an IRS late payment penalty calculator we are able to come up with a pretty close estimate. Web A late payment fee is an amount added to the balance of an invoice when it isnt paid by the due date. Web Late Fee.

Then multiply it by 90 days to arrive at the total. When payments are made solely for financing purposes or in advance except for. Web If a payment is less than 31 days late use the Simple Daily Interest Calculator.

Web This late interest online calculator will calculate the amount of monthly compounding interest owed on payments made after the payment due date. Web If your payment is only 30 days late or less please use the simple daily interest calculator. Web So if you owe the IRS 1000 and youre 90 days late first calculate your daily interest charge which would be about 0082.

Shopify Fees 2023 Transaction Monthly Fees Calculator

Iaumjgl25twgxm

Dynamic Calculation Of Weekly Total Microsoft Fabric Community

Global Version Launch X431 Crp919e Bi Directional Diagnostic Tool Supports Ecu Coding

Polymorphism Dependent 9 Phosphoanthracene Derivative Exhibiting Thermally Activated Delayed Fluorescence A Computational Investigation The Journal Of Physical Chemistry A

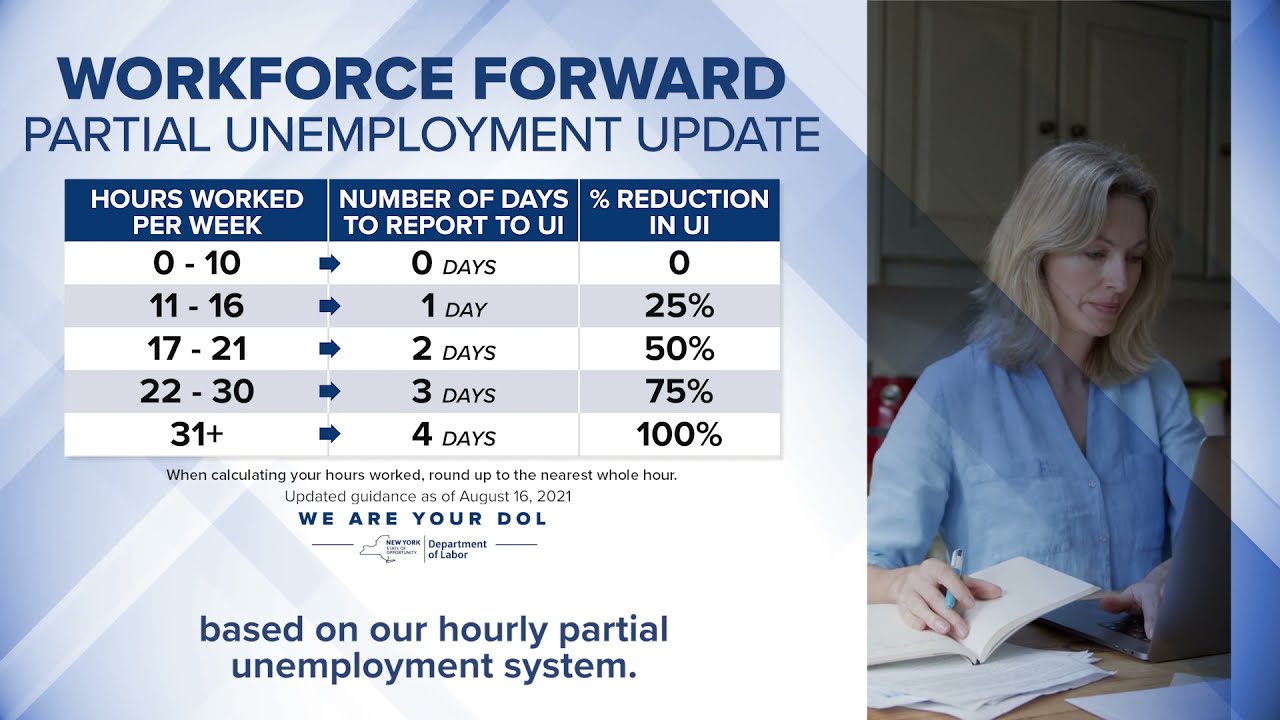

Partial Unemployment Eligibility Department Of Labor

Launch X431 Crp919e Bt Crp919ebt Obd2 Scanner Support Can Fd Doip 31 Resets

Iaumjgl25twgxm

Iaumjgl25twgxm

Amazon Flipkart Instant Credit Offers Decoded

Qt0a2mba6xzrom

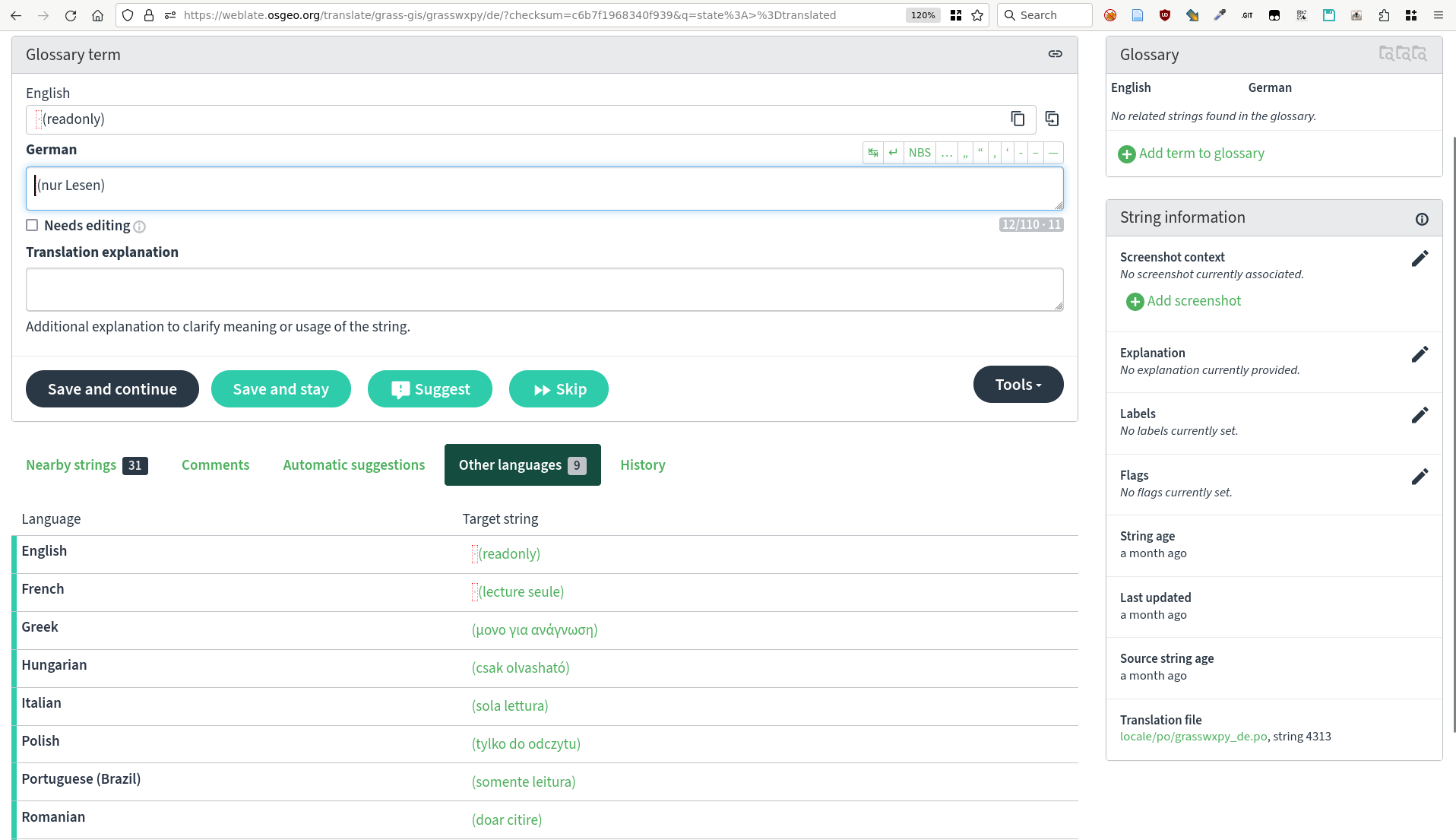

Usage Input

Late Payment Fees Calculation Manager Forum

Analysis Of Gstr 3b Late Fees Levied On Gstn Portal

Kingbolen K8 V Car Diagnostic Tool Auto Obd2 Scanner Bidirectional Key Coding Ebay

Iaumjgl25twgxm

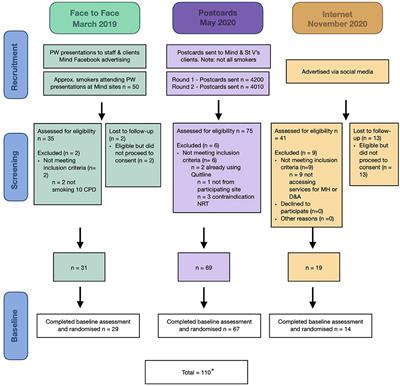

Frontiers Adapting Peer Researcher Facilitated Strategies To Recruit People Receiving Mental Health Services To A Tobacco Treatment Trial